Welcome to our September newsletter. This month, we take a look at the conditions of the U.S. and global economies in relation to the local, state, and national real estate markets. In particular, we examine some crucial economic indicators, Real Gross Domestic Product (GDP) and the unemployment rate. Although COVID-19 is still surging through California and the country, sellers are returning to the market, bringing some much-needed supply to meet buyer demand. As we make our way through the summer months, we continue to provide you with the most up-to-date market information so that you feel supported and informed in your buying and selling decisions.

In this month’s newsletter, we cover the following:

-

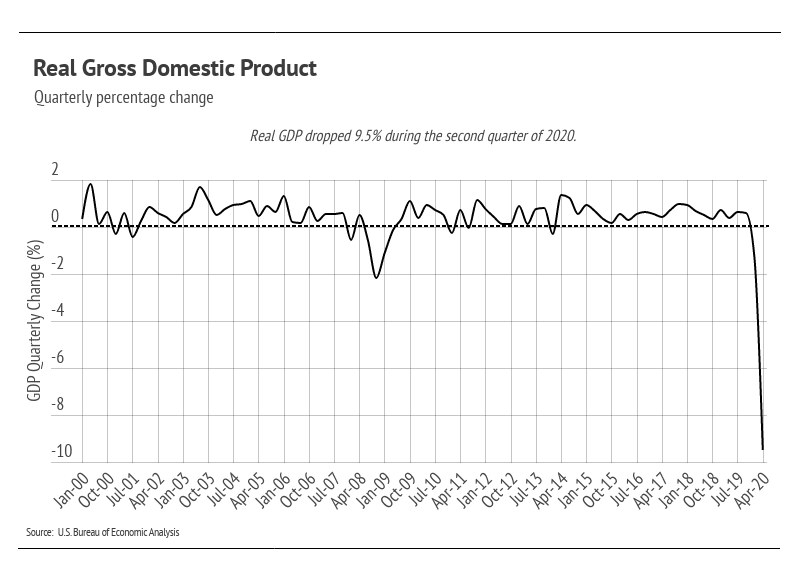

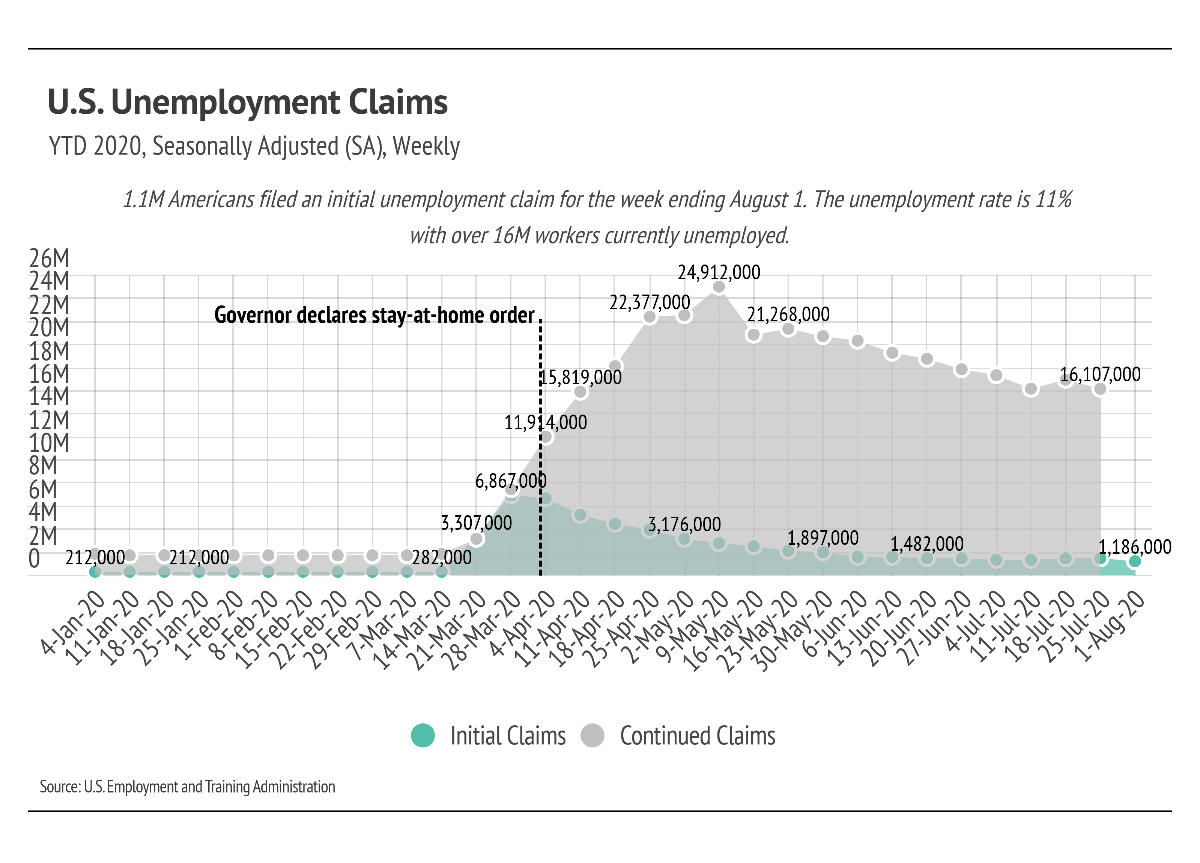

Key News and Trends in August: U.S. GDP fell 9.5% in 2020’s second quarter. The national unemployment rate is 11% as of August 6, 2020, and 30-year fixed mortgage rates hit historic lows in July. COVID-19 continues to spread in the United States, although new cases seem to be marginally decreasing in California and nationally.

-

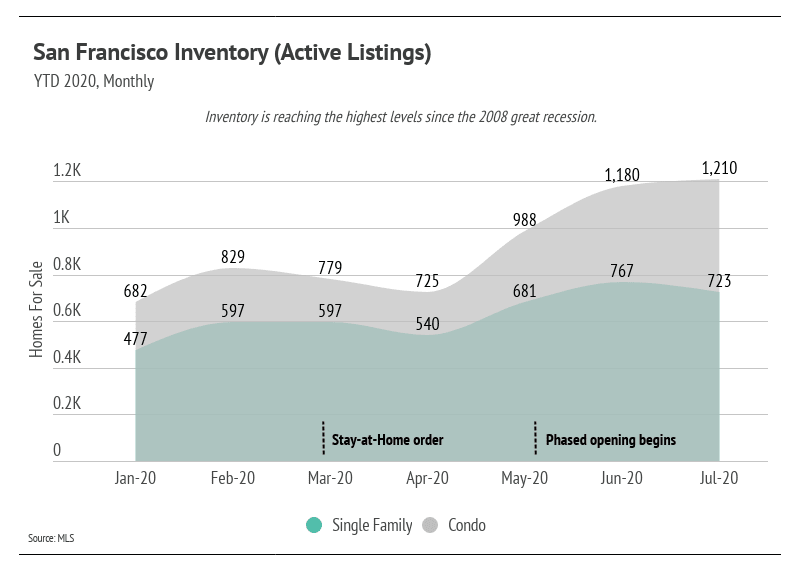

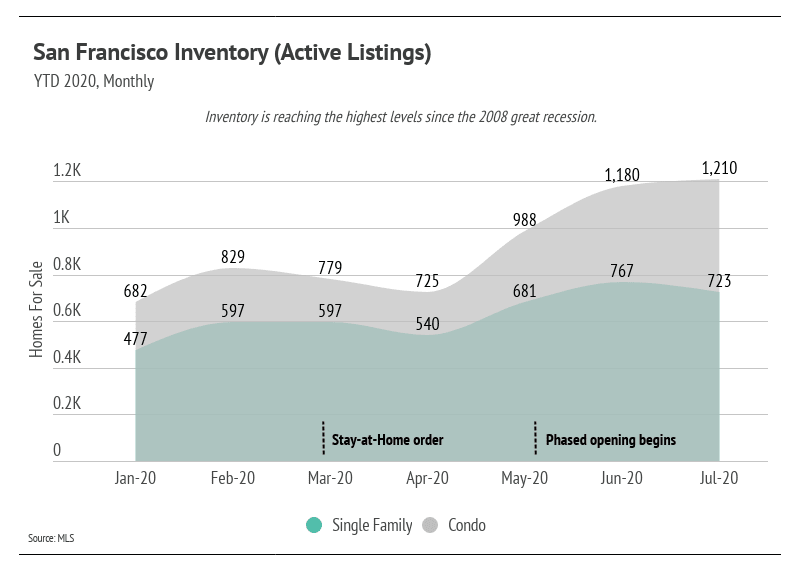

August Housing Market Updates: San Francisco’s housing market sees the largest number of homes for sale since the 2008 recession as sellers re-enter the market.

Key News and Trends in August

The National Bureau of Economic Research officially deemed February 2020 the most recent U.S. economic peak ending the decade-long expansionary economic cycle, which means we are in a recession until we begin another growth cycle. Unlike the last recession between 2007 and 2009, which was heavily tied to the housing market, the current COVID-induced recession is less likely to affect the housing market, at least in the short-term.

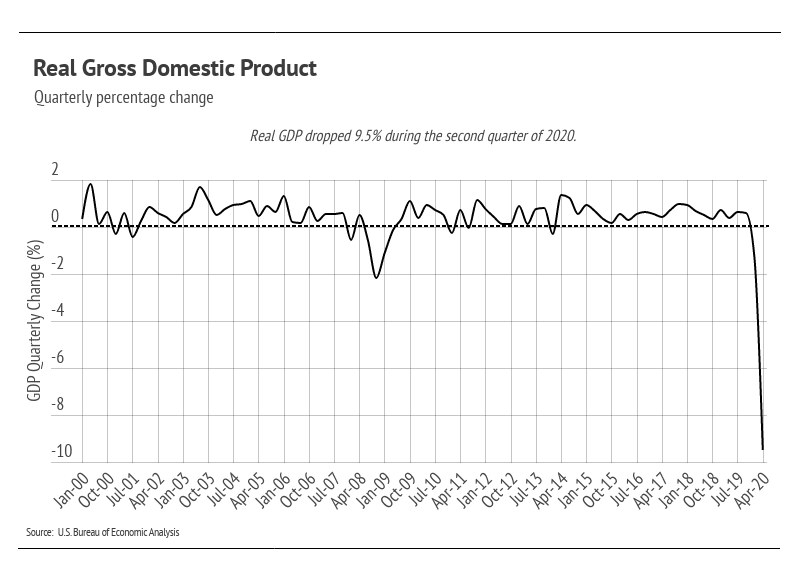

During the second quarter of 2020, home prices rose nationally while GDP—the broadest measure of goods and services produced—dropped 9.5% quarter-over-quarter. GDP and the housing market usually trend together over time. The connection between the two is quite simple: overall personal income should rise as GDP increases, thereby accumulating enough wealth to purchase a home.

Because demand for housing still outpaces supply, the negative GDP figure will likely not significantly impact housing unless it persists through the next year. Perhaps the more pertinent news regarding GDP is that the federal government offset the drop in production and spending through COVID-19 relief and stimulus measures. Specifically, the recipients of the $600 per week federal unemployment supplement, which ended July 31, largely infused that money back into the economy.

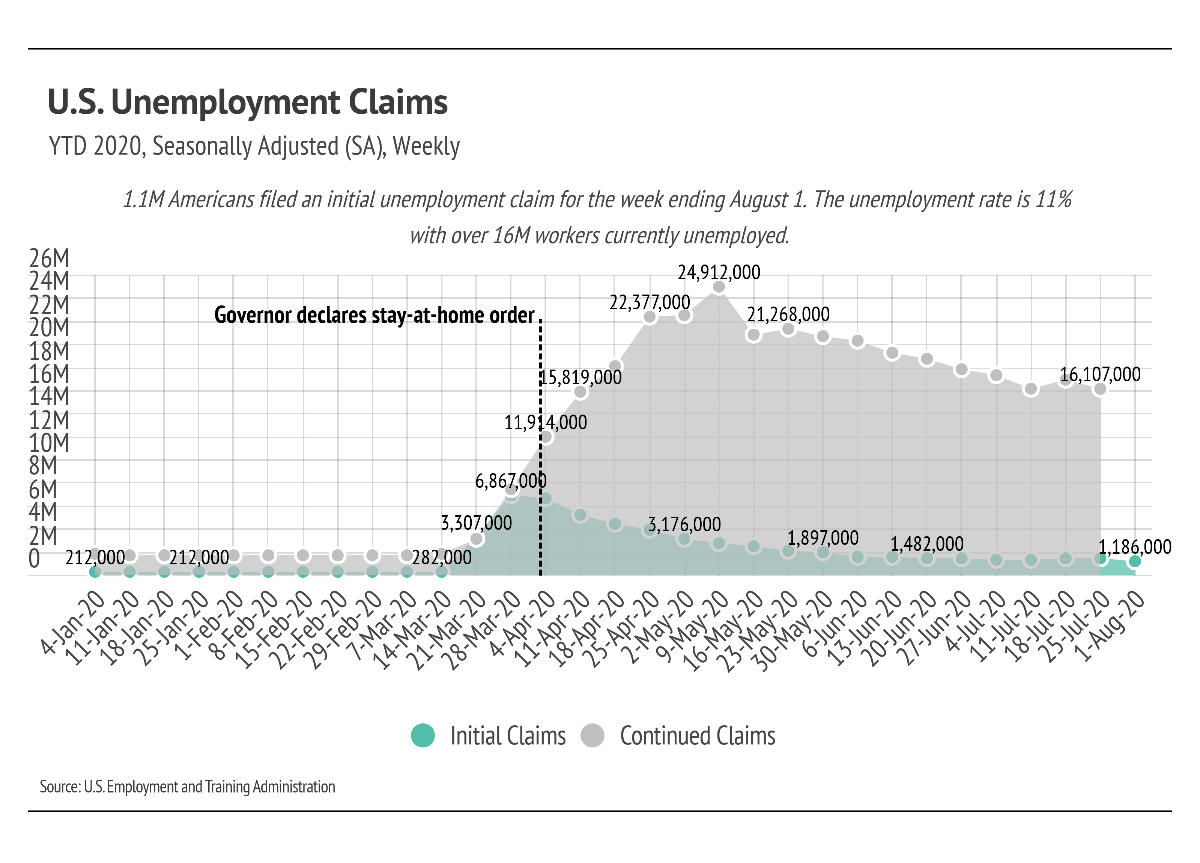

The number of continued unemployment claims, those that continue collecting unemployment after their initial claim, has not dropped as precipitously as was hoped. As mentioned in previous newsletters, the initial projections for when the virus would be under control was mid-July, which did not come to pass. As the United States navigates its way through its pandemic response, 16 million unemployed workers continue to collect unemployment benefits. Economists estimate that the actual number of unemployed workers is around 25 million.

Unemployment claims continue to cause some of the biggest concerns about the overall economy. If people continue to collect unemployment rather than going back to work, those cases will turn into permanent, rather than temporary, job losses. Moreover, many businesses face permanent closure as time passes, which permanently reduces the total number of jobs available.

Fewer jobs amid already high unemployment rates could lead to a long road to economic recovery and evictions. In the short-term, rental properties may experience a squeeze in profits. As we continue to monitor the market, we will look for unusual upticks in rental properties coming to market, suggesting this trend is underway.

On the other hand, the pandemic has left many with more money than usual as their personal spending has dropped considerably. Those interested and able to buy a home are in the lowest interest rate environment in history. Freddie Mac reports that the interest rate on a 30-year fixed mortgage is at 2.88%. This is the first time the rate has dropped below 3%.

As we have discussed in previous newsletters, the affordability of a home increases (or decreases) significantly with each percentage of interest. A loan for a median-priced home from January 2020 at a rate of 3.72% costs $700 per month more than a loan at 2.88%, amounting to $250,000 over the life of the loan. As a result, we have seen a boom in refinancing, which we expect to continue for homeowners who do not wish to move. For buyers (or refinancers), this could be the lowest interest rate they will experience in their lifetime and an excellent time to execute the purchase of a home.

August Housing Market Updates for San Francisco

August Housing Market Updates for San Francisco

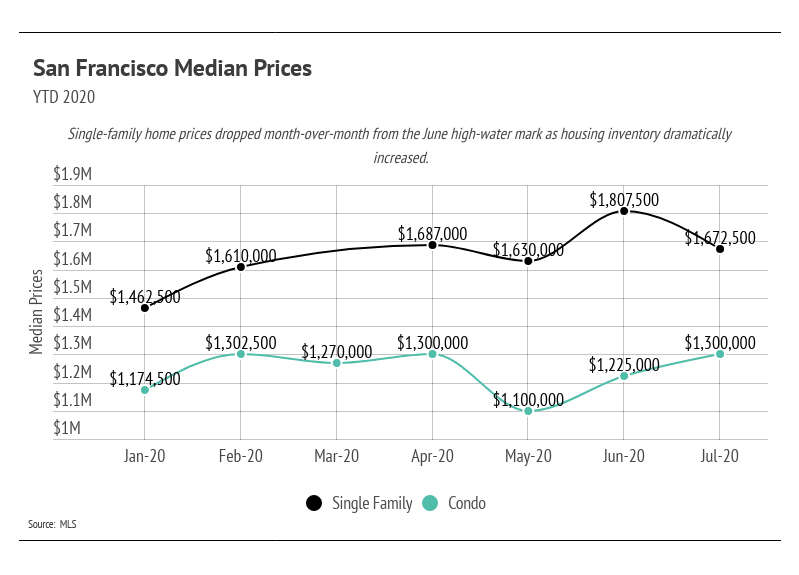

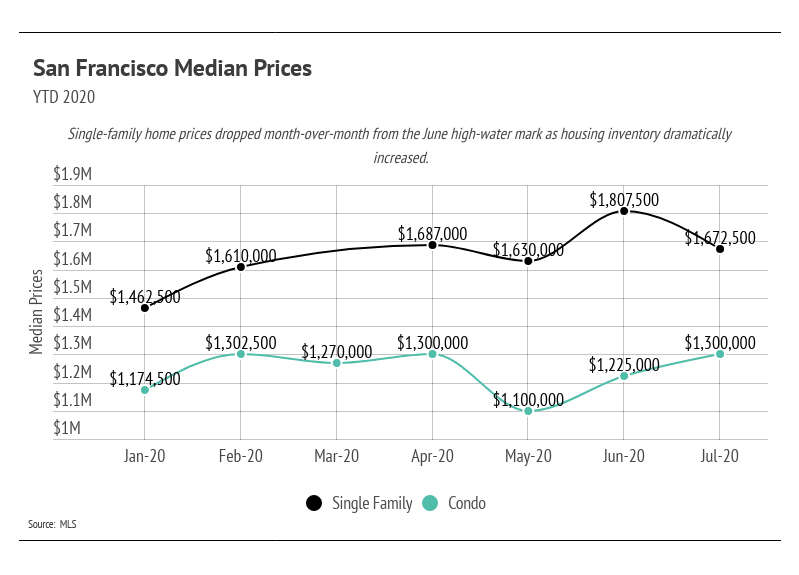

In July, single-family home prices dropped slightly from the June 2020 all-time peak as more inventory came to market. The condo market saw a noticeable increase in median price and looks to be rebounding.

Year-over-year, single-family home prices are up 6% from this time last year, while condos are up 3%.

SFGate reports

SFGate reports that the inventory of homes for sale increased to the highest levels since the 2008 recession. Typically, a surge in supply would bring down prices; however, demand still outpaces supply even with the 40% year-over-year increase in active listings. San Francisco’s prices tend to be buoyed by lack of supply compared to demand, which still remains true. We believe that the supply will make the market more efficient in that buyers will have more options to find what they actually want, leading to more sales. San Francisco needed more supply, so we view the influx as a net positive for the market.

We can look to Months of Supply Inventory (MSI)—the measure of how many months it would take for all current homes for sale on the market to sell at the current rate of sales—as a proxy for demand. MSI has an average of three months in California. An MSI lower than three means that buyers are dominating the market and there are relatively few sellers; a higher MSI means there are more sellers than buyers. In July, the MSI for single-family homes fell well below the three-month mark and now heavily favors sellers once again. The MSI of condos was not as tight; however, it is trending lower even with increasing inventory.

As we would expect, the number of

homes under contract continued to trend upward in July, which contributed to the falling MSI and highlights the amount of demand even further. Single-family homes under contract increased 48%, and condos increased 21% year-over-year. Based on these metrics, we believe the housing market is thriving. We’ve seen reporting on a rumored exodus from the city for bigger, less expensive spaces, but the data shows the contrary.

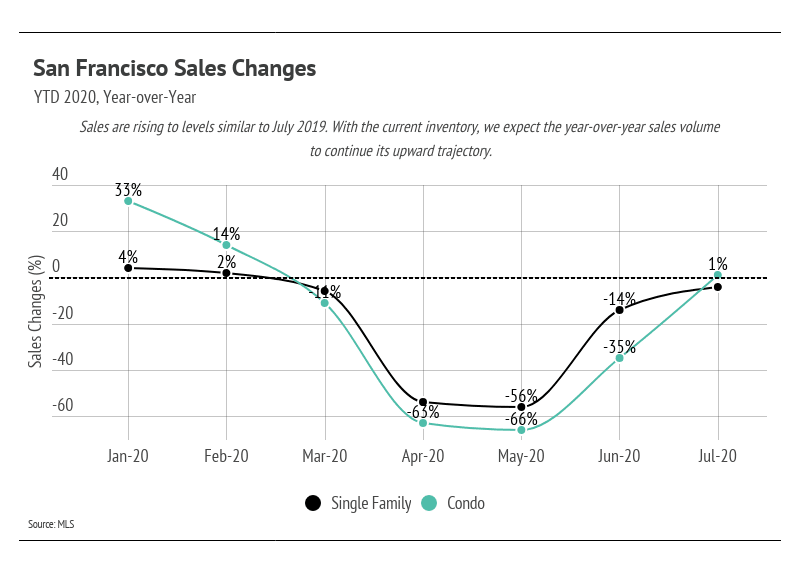

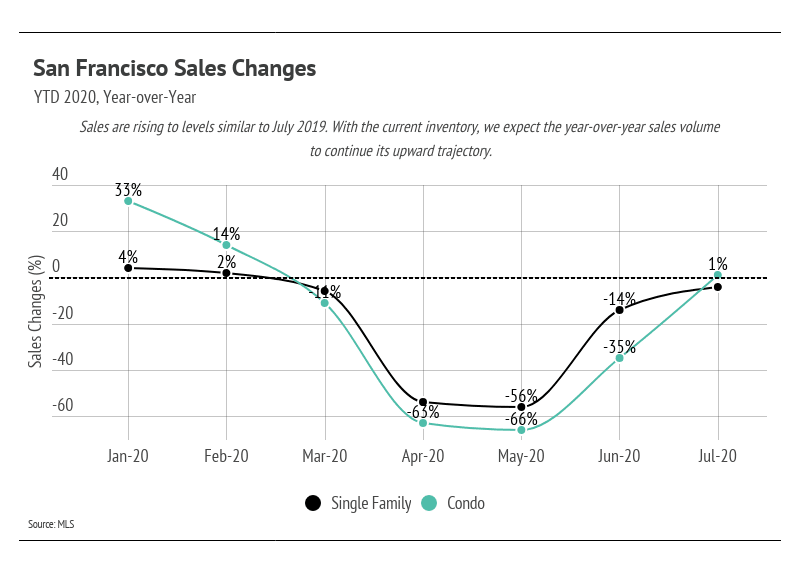

We can also analyze home sales—the result of homes under contract that close within 30 days—on a monthly basis, while also comparing them to last year’s numbers. Sales are close to flat year-over-year for both single-family homes and condos, which is a remarkable recovery from May’s year-over-year sales volume. Increased inventory combined with homes under contract resulting in sales suggests that sales volume should continue rising.

As both inventory and sales increase, the percentage of homes with price changes has increased as well. This is a natural phenomenon with higher supply levels and does not indicate price contraction.

Record prices attest to the fact that homes are generally selling above list prices. July’s sale-to-list ratios—which compare the prices buyers pay to the listed prices of homes—suggest that buyers are not paying large premiums. The chart below illustrates the price that the average San Francisco buyer negotiated to put a property under contract, and whether or not it was above or below list price. In July, both single-family homes and condos sold in-line with original list prices. Single-family home and condo buyers can expect to pay around the listed price.

In summary, the difficulty that the housing market experienced in March through June, as evidenced by sales volume and supply, has subsided. The housing market has shown its resilience through the pandemic and remains one of the safest asset classes. Whether you are buying or selling a home, it is still incredibly important to seek out the advice of real estate experts.

Moving forward, we anticipate more sellers coming to market. The initial seller reticence caused by COVID-19 seems to have subsided, increasing supply. As more supply becomes available, there could be a small price correction in the market, but we do not believe that will occur during the summer months while demand is so high.

As always, we remain committed to helping our clients achieve their current and future real estate goals. Our team of experienced professionals are happy to discuss the information we have shared in this newsletter. We welcome you to contact us with any questions about the current market or to request an evaluation of your home or condo.

Unemployment claims continue to cause some of the biggest concerns about the overall economy. If people continue to collect unemployment rather than going back to work, those cases will turn into permanent, rather than temporary, job losses. Moreover, many businesses face permanent closure as time passes, which permanently reduces the total number of jobs available.

Unemployment claims continue to cause some of the biggest concerns about the overall economy. If people continue to collect unemployment rather than going back to work, those cases will turn into permanent, rather than temporary, job losses. Moreover, many businesses face permanent closure as time passes, which permanently reduces the total number of jobs available. August Housing Market Updates for San Francisco

August Housing Market Updates for San Francisco

SFGate reports that the inventory of homes for sale increased to the highest levels since the 2008 recession. Typically, a surge in supply would bring down prices; however, demand still outpaces supply even with the 40% year-over-year increase in active listings. San Francisco’s prices tend to be buoyed by lack of supply compared to demand, which still remains true. We believe that the supply will make the market more efficient in that buyers will have more options to find what they actually want, leading to more sales. San Francisco needed more supply, so we view the influx as a net positive for the market.

SFGate reports that the inventory of homes for sale increased to the highest levels since the 2008 recession. Typically, a surge in supply would bring down prices; however, demand still outpaces supply even with the 40% year-over-year increase in active listings. San Francisco’s prices tend to be buoyed by lack of supply compared to demand, which still remains true. We believe that the supply will make the market more efficient in that buyers will have more options to find what they actually want, leading to more sales. San Francisco needed more supply, so we view the influx as a net positive for the market.

As we would expect, the number of homes under contract continued to trend upward in July, which contributed to the falling MSI and highlights the amount of demand even further. Single-family homes under contract increased 48%, and condos increased 21% year-over-year. Based on these metrics, we believe the housing market is thriving. We’ve seen reporting on a rumored exodus from the city for bigger, less expensive spaces, but the data shows the contrary.

As we would expect, the number of homes under contract continued to trend upward in July, which contributed to the falling MSI and highlights the amount of demand even further. Single-family homes under contract increased 48%, and condos increased 21% year-over-year. Based on these metrics, we believe the housing market is thriving. We’ve seen reporting on a rumored exodus from the city for bigger, less expensive spaces, but the data shows the contrary.

As both inventory and sales increase, the percentage of homes with price changes has increased as well. This is a natural phenomenon with higher supply levels and does not indicate price contraction.

As both inventory and sales increase, the percentage of homes with price changes has increased as well. This is a natural phenomenon with higher supply levels and does not indicate price contraction.